- 16 March 2025

Insights into Türkiye’s February 2025 Real Estate Market

Insights into Türkiye’s February 2025 Real Estate Market

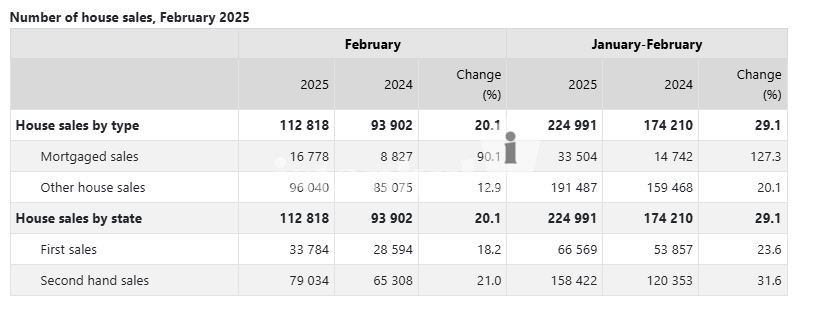

Türkiye’s housing market is showcasing robust growth as evidenced by the latest statistics for February 2025 Real Estate. With a total of 112,818 houses sold in the month—a 20.1% increase compared to February 2024—the market is brimming with activity. This surge not only reflects strong domestic demand but also highlights shifting trends within different sales segments and geographical areas.

Overview of Market Performance

The impressive increase in house sales during February and the January-February period provides a snapshot of the market’s vitality. Key highlights include:

- Total Houses Sold in February: 112,818 (up 20.1% year-on-year)

- Cumulative Sales (January-February): 224,991 houses, marking a 29.1% increase

- Leading Provinces: İstanbul, Ankara, İzmir

- Lagging Provinces: Ardahan, Tunceli, Bayburt

These figures underscore a significant upswing in the housing market, driven by both improved buyer confidence and favorable economic conditions.

Geographical Insights

The distribution of house sales across provinces offers further context to the overall performance:

-

Top Performing Provinces:

- İstanbul: 19,347 houses sold

- Ankara: 10,791 houses sold

- İzmir: 6,899 houses sold

-

Lowest Performing Provinces:

- Ardahan: 24 houses sold

- Tunceli: 70 houses sold

- Bayburt: 73 houses sold

The concentration of sales in major cities like İstanbul, Ankara, and İzmir highlights the persistent appeal of urban centers, whereas smaller provinces are experiencing much lower transaction volumes.

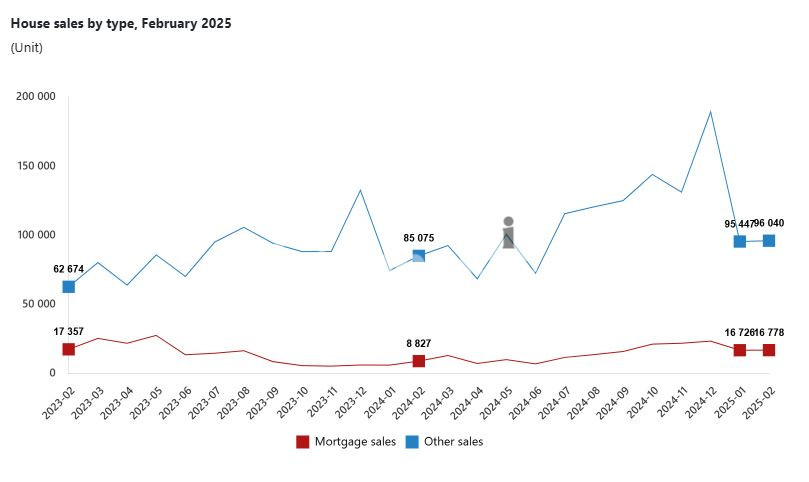

Mortgaged vs. Other House Sales

The market dynamics become even more intriguing when examining the breakdown by type:

Mortgaged House Sales

Mortgaged house sales have witnessed a remarkable leap, reflecting improved access to financing:

- February Sales: 16,778 houses, up 90.1% compared to February 2024

- Share of Total Sales: 14.9%

- January-February Period: 33,504 houses, a 127.3% increase year-on-year

- First Sales within Mortgaged Transactions:

- February: 3,956 houses

- January-February: 7,812 houses

Other House Sales

Non-mortgaged (or other) house sales continue to be the backbone of the market:

- February Sales: 96,040 houses, showing a 12.9% increase

- Share of Total Sales: 85.1%

- January-February Period: 191,487 houses, up 20.1% from the previous year

This clear segmentation shows that while traditional cash or alternative financing remains dominant, the mortgage segment is rapidly catching up due to more attractive lending conditions and an expanding pool of qualified buyers.

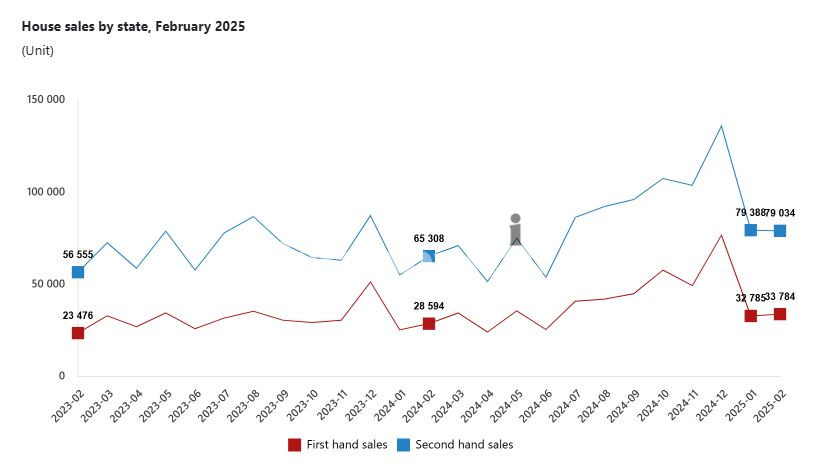

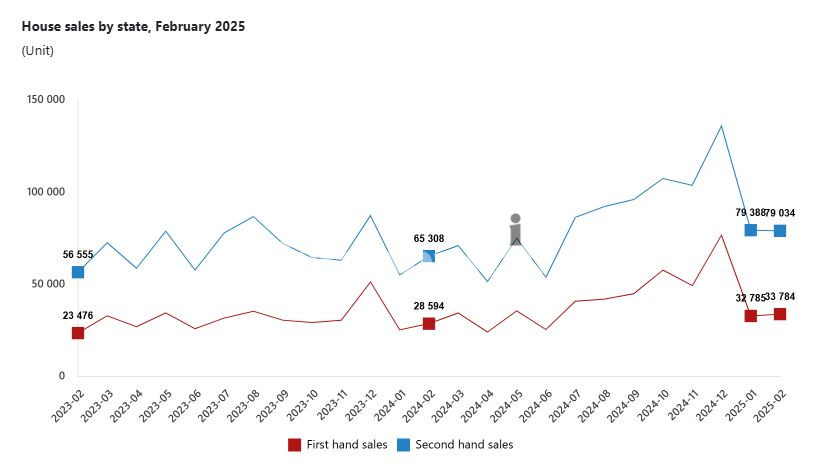

First-Time vs. Second-Hand House Sales

Understanding buyer behavior further, the statistics distinguish between first-time purchases and second-hand transactions:

-

First-Time House Sales:

- February: 33,784 houses (an 18.2% increase), representing 29.9% of total sales

- January-February: 66,569 houses, up 23.6% year-on-year

-

Second-Hand House Sales:

- February: 79,034 houses (a 21.0% increase), making up 70.1% of total sales

- January-February: 158,422 houses, a substantial 31.6% increase compared to the previous year

These figures indicate that while new purchases are growing steadily, the demand for pre-owned properties is even more pronounced, signaling a dynamic market with diverse buyer interests.

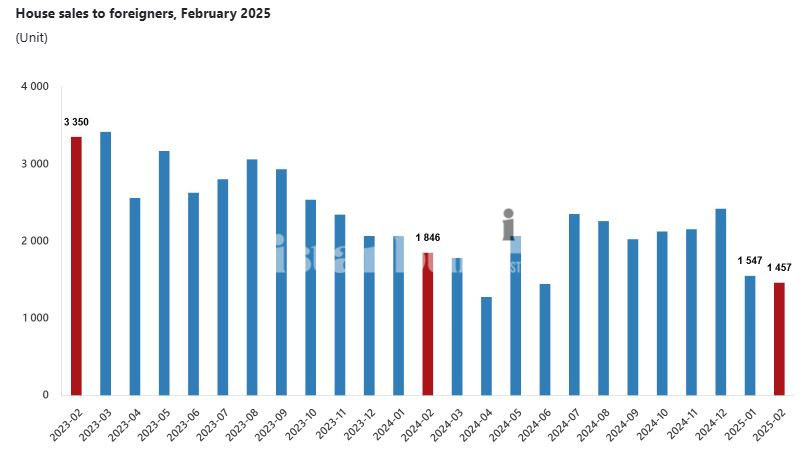

Foreign Buyer Trends

Foreign investment in the Turkish housing market shows a contrasting pattern compared to domestic sales. In February 2025:

- Houses Sold to Foreigners: 1,457 houses (down 21.1% year-on-year), constituting only 1.3% of all sales

- Key Provinces Attracting Foreign Buyers:

- İstanbul: 539 houses

- Antalya: 503 houses

- Mersin: 89 houses

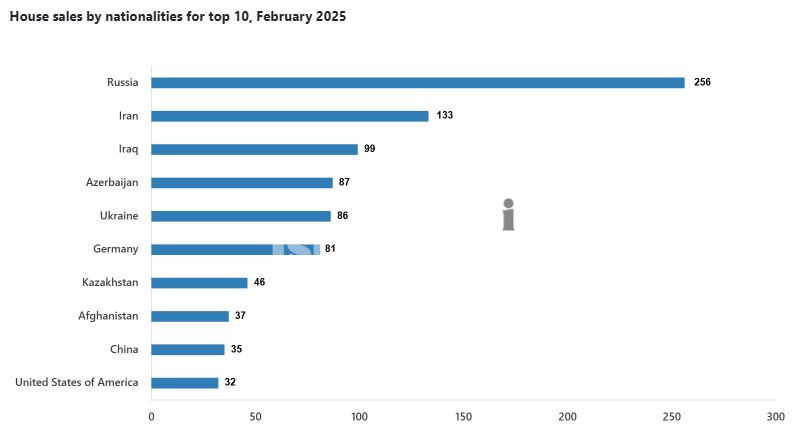

For the January-February period, foreign sales decreased by 23.1% to 3,004 houses. Additionally, when analyzing sales by nationality, the leading groups include:

- Russian Citizens: 256 houses

- Iranian Citizens: 133 houses

- Iraqi Citizens: 99 houses

The decline in foreign buyer activity could be attributed to broader economic factors or shifts in investment strategies, yet these transactions still form an essential part of the market’s diversity.

Key Market Trends and Takeaways

Several trends emerge from these statistics, offering valuable insights for buyers, sellers, and market analysts:

Several trends emerge from these statistics, offering valuable insights for buyers, sellers, and market analysts:

- Robust Overall Growth: With a significant jump in both monthly and cumulative sales, the market is experiencing a notable upward trajectory.

- Financing Trends: The dramatic increase in mortgaged house sales indicates a growing reliance on financial products, suggesting improved lending conditions and a broader base of buyers.

- Diverse Buyer Segments: Both first-time buyers and second-hand property buyers are contributing to the market’s momentum, each showing healthy year-on-year growth.

- Urban Concentration: Major cities continue to dominate the market, though smaller provinces lag, reflecting disparities in regional economic activity.

- Foreign Investment Dynamics: While still an important component, foreign transactions have declined, potentially signaling a more cautious approach among international buyers.

The February 2025 house sales statistics paint a picture of a thriving Turkish real estate market. Strong domestic performance across various segments—mortgaged and non-mortgaged, first-time and second-hand—underscores the market’s resilience and adaptability. Even as foreign investment shows a slight dip, the overall trends suggest that Türkiye’s housing market is set on a path of robust growth. With ongoing improvements in financing and a vibrant urban real estate scene, stakeholders can look forward to a promising future in this dynamic sector.