- 28 April 2024

Overview Of Türkiye’s Housing Market In March 2024

Overview Of Türkiye’s Housing Market In March 2024

In March 2024, Türkiye’s real estate market showed various developments, giving us a detailed look at the housing sector. While there was a small decrease in house sales overall, the market proved steady and diverse, with different parts showing different trends.

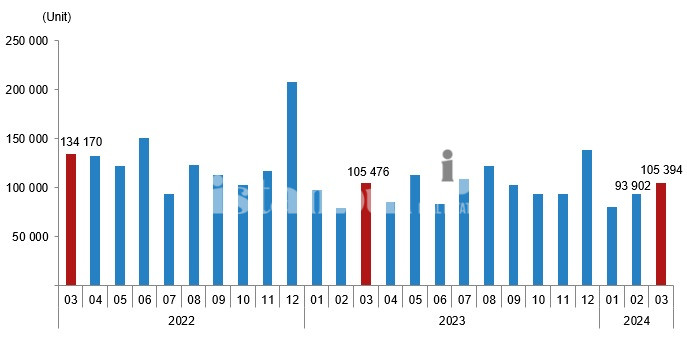

In March, Türkiye saw a slight dip of 0.1% in house sales compared to the same month last year, totaling 105,394 transactions. İstanbul emerged as the competitor, accounting for a 18.1% share with 19,040 houses sold. Ankara and İzmir followed with 9,523 and 6,413 sales, respectively, capturing 9.0% and 6.1% of the market. Additionally, Ardahan, Bayburt, and Hakkari recorded the lowest sales figures, with only 23, 42, and 55 houses sold, respectively.

Property Sales In January-March 2024

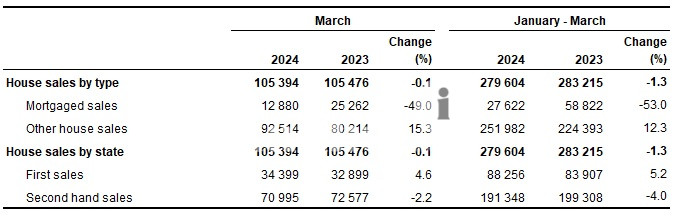

In March 2024, Türkiye recorded 105,394 house sales, marking a slight decrease of 0.1% compared to the same period last year. This dip was part of a broader trend, as house sales in the January-March period saw a 1.3% decline, amounting to 279,604 sales.

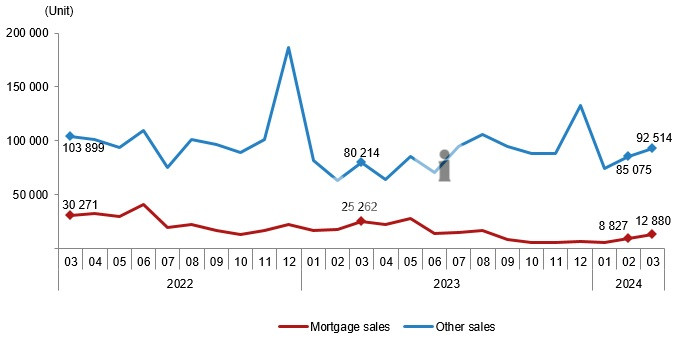

Mortgaged vs. Other House Sales

-

Housing Market In March In March, the number of mortgaged house sales in Turkey dropped by 49.0% compared to the same month last year, totaling 12,880 transactions.

- Mortgaged house sales accounted for 12.2% of all house sales during this period.

- In the first quarter of the year (January-March), mortgaged house sales witnessed a significant decline of 53.0% compared to the previous year, reaching a total of 27,622 transactions.

- Among the mortgaged house sales in March, 3,105 were first-time transactions.

- In the January-March period, 6,569 of the mortgaged house sales were first-time purchases

Type of Sales

In March, Turkey’s housing market saw significant changes. Mortgaged house sales dropped by 49.0%, totaling 12,880 transactions, comprising 12.2% of all house sales. Meanwhile, other house sales surged by 15.3%, reaching 92,514 transactions, dominating the market at 87.8%.

Throughout the first quarter, mortgaged house sales fell by 53.0%, while other house sales increased by 12.3%, totaling 27,622 and 251,982 transactions, respectively.

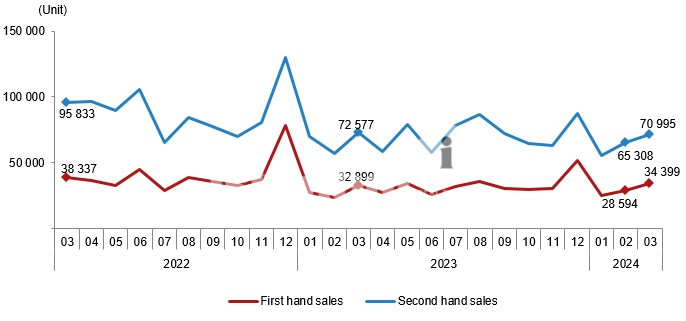

Breaking down March’s sales, first-time house sales rose by 4.6% to 34,399 transactions, making up 32.6% of total sales. Similarly, second-hand house sales decreased by 2.2% to 70,995 transactions, comprising 67.4% of all sales. Over the quarter, first-time sales increased by 5.2%, while second-hand sales decreased by 4.0%, reaching 88,256 and 191,348 transactions, respectively.

Foreign Investment

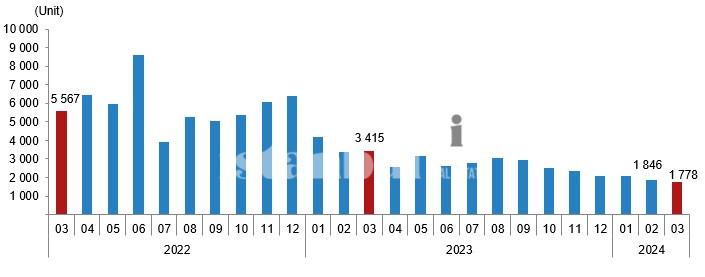

In March, the housing market in Turkey witnessed a significant decline in sales to foreigners, with only a thousand 778 houses sold, marking a sharp 47.9% decrease compared to the previous year. These transactions accounted for a modest 1.7% share of total house sales for the month.

In March, the housing market in Turkey witnessed a significant decline in sales to foreigners, with only a thousand 778 houses sold, marking a sharp 47.9% decrease compared to the previous year. These transactions accounted for a modest 1.7% share of total house sales for the month.

Istanbul led the way in foreign property sales, recording 652 transactions, followed closely by Antalya with 618 sales and Mersin with 151 sales to foreigners.

Looking at the broader picture, house sales to foreigners in the January-March period plummeted by 48.0% compared to the same period the previous year, totaling 5 thousand 685 transactions.

Looking at the broader picture, house sales to foreigners in the January-March period plummeted by 48.0% compared to the same period the previous year, totaling 5 thousand 685 transactions.

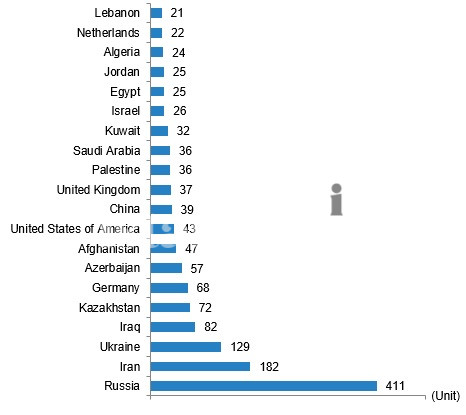

Breaking down the nationality of buyers in March, Russian citizens emerged as the top buyers, purchasing 411 houses in Turkey. They were followed by Iranian citizens with 182 transactions, Ukrainian citizens with 129 transactions, and Iraqi citizens with 82 transactions.

Implications and Future Outlook

Türkiye’s housing market continues to navigate through fluctuations influenced by both domestic and global factors. While certain segments experienced declines, others exhibited resilience and growth, showcasing the sector’s adaptability. As the country aims for economic stability and growth, monitoring these trends becomes crucial for stakeholders, providing insights into consumer behavior, investment patterns, and policy implications.

Related Posts

Why Investors Should Purchase Property In Turkey Real Estate